79 acres at 325–440th Ave. and Indian School Road. Potential 1‑acre subdivision after water and electric. Parcel releases, rolling options, terms up to 40 years. Tonopah, AZ — 50 miles west of Phoenix. Ideal for mobile home or residential development.

Retired ER doctor owns $60 million in scattered desert inventory (59 parcels ranging from 10–320 acres) in West Phoenix/Northwest areas. Parcel‑split strategy opportunity for 3–5 acre splits. Terms and parcel releases to fit your plan. Properties range from landlocked Grand Ave. parcels to Jomax areas with high income and residential development potential. Joint venture options with civil engineers available.

High‑potential Motel 6 site for 50–100 unit motel targeting truckers. Joint venture 50/50 — 7.5 acres at $1M.

Planned 8‑story, 2,000‑space parking garage near Sky Harbor Airport, Phoenix, AZ. JV structure: 3.3 acres ($12M land) with a $6M subordinate component. Joint Venture 50/50 after your $18M construction with one of the largest international construction companies.

Investors interested in buying $100 million worth of farmland for alfalfa shipment to China from Long Beach, California.

Investor buyers actively seeking mini‑storage sites or existing buildings.

Major $50M international buyers seeking large farms between Yuma and Phoenix for alfalfa — 6,000–20,000 acres wanted in the Buckeye → Yuma region.

Regional gas station site buyer seeking five I‑303 freeway locations, 1–3 acres each, priced $500,000–$1,250,000 per site. Commercial zoning only.

Heavy‑credentialed mortgage broker available with SBA, FHA, VA, USDA, hard money and traditional financing sources for project funding.

Junkyard operator seeks 5–10 acre industrial site in 35th Ave./Broadway or similar Phoenix/Tempe locations under $1M. Needs A1/A2 industrial zoning. Owner has possible trade options including a luxury mansion and $250,000 home.

One of Arizona’s largest shopping center developer‑owners seeking regional freeway sites.

Major Casa Grande land inventory (estate sale) with lots to sections of land. Parcel splits and terms available — strong opportunity for small parcel strategies (3–5 acre splits) without full subdivision.

Major regional inventory of over 43,000 acres across the Yuma region — scattered farms, various irrigation districts, substantial water rights.

$500M joint venture opportunity for biofuel/refinery development tied to South Dakota oilfield infrastructure.

One of the largest U.S. solar companies seeks Arizona land “on the grid” to sell power to Southern California Edison (100‑mile grid path may be viable).

Large hospital foreclosure in Southeast Phoenix with old‑line, heavy industrial‑strength interior infrastructure — suitable for drug rehab, convalescent home or phased redevelopment. Development phases $2M–$7M.

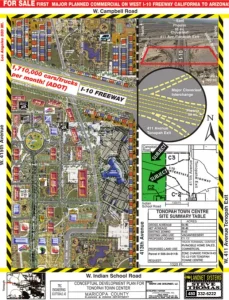

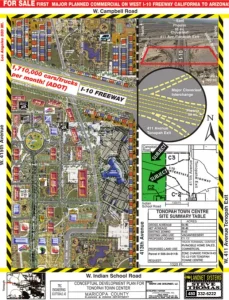

7.5 acre commercial site just west of 411th–420th Ave. and Indian School Road in Tonopah, AZ. The only C‑2 commercial site available in the region — first exit into Maricopa County. Optimum Motel site (Motel 6). $1 million — owner anxious, free/clear. Will exchange. Motel 6 has tentatively approved this site with no competition in a 20‑mile radius. Cash, trade or terms.

Four mansions wanted for conversion to Air B&B with upside to $25,000+/month. High‑end architect, engineer, developer and interior decorator JV partners ready. Seeking free‑and‑clear homes $1–5M. We also have mansion inventory for JV renovations.

Comprehensive Holstein dairy opportunity: 115 acres, double barn, two 5,000‑gal tanks, 1,700 milking cows, 900 heifers, pens, 3,000 tons hay, two wells — forming a contiguous 2,500‑acre alfalfa operation. Equipment and rolling inventory valued at $450,000. Total package valued at $30M; asking $17M (includes cows, milk base, land, equipment, goodwill). Farm Credit Bureau financing possible.

65 acres on both sides of I‑10 Freeway west of 411th Ave. and Indian School Road to Campbell — Tonopah, AZ (50 miles west of Phoenix). Planned major truck terminal site with mixed‑use commercial and high‑income potential for commercial and industrial development. Build hotels, restaurants, industrial storage, truck storage and trailers. Exchange for mansions, rental homes, notes, San Francisco or Phoenix areas. Last closed for $11 million, free/clear — for the right transaction will go down to $6 million. Can include rental homes, SF mansion, $250,000 priceless paintings. Millions of sq. ft. of industrial buildings about ½ mile SW. Truckers’ paradise on I‑10 — storage, warehousing, retail. An anxious seller — will exchange for rental homes, mansions, land, buildings while you build an empire on this site. Call (480) 332‑6222 d / (480) 998‑9909 x101.

3,500 acre major alfalfa farm with 10 acre‑feet of water outside the active management area. Asking $35M.

Over $150 million available for exchange for your land, income properties, industrial, commercial, residential, empty warehouses, and large free-and-clear homes. Call for additional niche requests tailored to your next real‑estate empire success.

10 acres near the new Apple Silicon Glass Factory and the Williams Gateway Center in Mesa. Potential commercial site — attractive to Apple vendors and supply chain companies.

1000‑head Holstein dairy with carrying capacity — marketed value $20 million; selling price $3 million (as‑is).

35,000 acre‑feet of water for sale. Purchase by the acre‑foot.

3,700 acres in the West Buckeye/Gila Bend Paloma Ranch area at $5,000 per acre with 6 acre‑feet of water per parcel. Some flood plain.

163 acres west of Casa Grande Mountain. Potential hotel site or RV/mobile home park subdivision. Spectacular mountain backdrop and strong lease‑up prospects.

18,000 acres of state grazing leases with rolling options convertible to irrigated farms. Add wells per 160 acres with circle irrigation. JV opportunity at $500 per acre lease (10‑year rolling options) plus $1,400 per acre improvements (water, pipes, wells). Total projected cost: $3,500 per acre irrigated for large‑scale alfalfa farming income.

20 acres in Queen Creek for commercial mixed use: gas station, apartments, mini strip mall, etc. $6 per sq. ft.

320 acres north of Lake Pleasant — one of Arizona’s potential fly‑in dry dock marinas. Develop RV park, mini‑storage, fly‑in dry dock marina, KOA campground. May exchange for a mansion.

Buckeye dairy with 2,000 head carrying capacity, milk base, cows and rolling stock. Asking $15M (reseller).

Former hotel acquisition executive seeking JV partner for high/low income hotel development.

Tap into our multibillion‑dollar inventory via three primary and five secondary online exclusive databases with a combined global investor contact base.

$100M in exchange opportunities — use IRS 1031 rules to defer taxes into your next investment.